Hello Fellow Investors,

If you’re a business owner, you already know the freedom and rewards that can come with running your own enterprise.

But here’s the harsh reality: you don’t get workers’ compensation or paid sick leave. That means if you can’t work, your income stops – while your bills keep coming in!

To protect your lifestyle and avoid financial stress, you need a safety net. Here are two essential steps every self-employed person should take:

Step 1: Build a Savings Buffer

Your savings buffer is your first line of defense. Without it, even a short illness or injury can spiral into long-term debt.

Consider this scenario:

- You earn $100,000 per year and spend roughly $6,431 per month.

- Suddenly, you can’t work for three months – perhaps due to a severe dental infection.

- When you recover, you’re back to earning $100K – except now you’re $18,000 in debt at 18% interest.

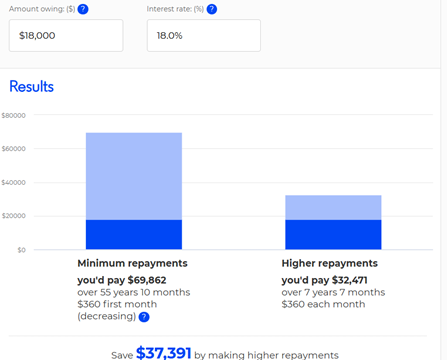

If you only make minimum repayments, that $18,000 could cost you $32,471 or more over time – see the table below. And all because you didn’t have a buffer!

A simple savings strategy can prevent this debt trap and give you peace of mind during unexpected setbacks.

Step 2: Income Protection for Business Owners

Savings alone may not be enough if you’re unable to work for an extended period. This is where income protection insurance comes in.

Income protection can replace up to 70% of your income if illness or injury keep you from working. For self-employed individuals, this is critical because unlike employees, you don’t have access to things like “paid sick leave” or “workers’ compensation”.

There is usually a minimum period that applies – often around 90 days – so if you’re off work with the flu for 2 weeks, your income protection policy is not going to help.

However, what if you’re sidelined for months or even years? Without income protection, you risk financial ruin.

Think it can’t happen to you? One fellow we know was healthy and fit, and loved bike-riding. On one such ride – through no fault of his own – he was hit by an e-scooter, which left him with life-threatening injuries. The good news is that after a lengthy stay in hospital he is now at home and doing well; however the recovery process is slow, and he will most likely be unable to return to work for several more months.

Needless to say, income protection is not just a smart move—it’s a necessity.

How to Set Up Income Protection

If you’re a business owner and ready to protect your income, you have a couple of great options:

- You can book a no-obligation, free initial consultation with a Financial Planner at our trusted Brisbane firm.

- Or, you can try our convenient new service: Personal Insurance Made Simple.

Joshua Napier

(Provisional Financial Planner)